Russia’s Oil Is Lastly Getting Snarled by Sanctions

[ad_1]

The Russian oil-export machine funding the Kremlin’s warfare in Ukraine is lastly getting some grit in its gears.

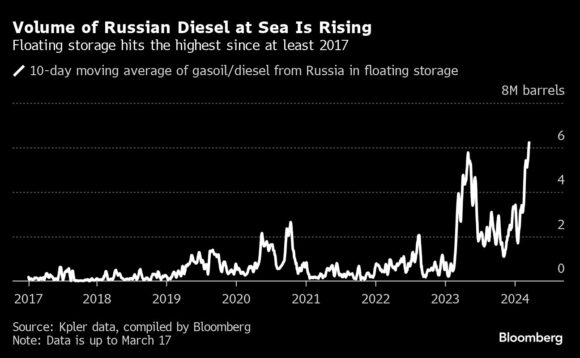

Indian oil refiners — Moscow’s second-biggest clients after China because the 2022 invasion — will not settle for tankers owned by state-run Sovcomflot PJSC due to the danger posed by sanctions.

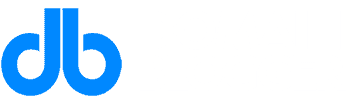

For the reason that begin of October, the US has ratcheted up sanctions on the broader fleet of tankers shifting Russian crude oil. Dozens of these focused have been languishing ever since, and extra barrels of Russian diesel are floating idly on the oceans than at any time since 2017, in accordance with analytics agency Kpler.

Taken collectively, these strikes have the potential to regularly constrict Russian petroleum revenues, a key coverage purpose of the US and its allies as they search to thwart army aggression by President Vladimir Putin.

The Group of Seven’s method to sanctions on Russia has been characterised by its refusal to trigger any ache to its personal economies within the type of larger oil costs. Washington got here up with the so-called worth cap coverage exactly to melt the sanctions that had been being cooked up in Brussels. And because the warfare began two years in the past, Russia has continued to export enormous quantities of oil.

Whereas there’s no expectation of drastic provide cuts at this stage, the query is how far western regulators will go in tightening the screws whereas oil costs head in the direction of $90 a barrel and President Joe Biden begins a grueling election marketing campaign with painful inflation nonetheless in voters’ minds.

“It’s a rising squeeze on Russian export flows, significantly to India,” stated Richard Bronze, head of geopolitics at guide Vitality Elements Ltd. “We’re on the stage the place sanctions-related friction is turning into very evident.”

Since October, the US has designated 40 particular person Russian oil tankers. 4 of the extra not too long ago focused ones are persevering with to make deliveries, however no sanctioned ship has collected a cargo since being named by the US Treasury, tanker monitoring knowledge compiled by Bloomberg present.

Now, an more and more powerful buying and selling setting has delivered a strong symbolic blow to the Kremlin as India — a stalwart industrial ally all through warfare — shuns its fleet. On the identical time, Ukraine has began blowing up Russian oil refineries, although it’s not clear how a lot help for the technique it enjoys in Washington.

“We’re positively seeing stepped up US sanctions strain on each Russian crude and on exports,” stated Greg Brew, an analyst at Eurasia Group in New York. “It comes at a time when the US is struggling to ship extra help to Ukraine, when Ukraine’s fortunes on the battlefield are beginning to decline, and when Russia seems to be gaining the higher hand.”

State-run Sovcomflot transported a couple of fifth of all Russia’s crude deliveries to India final yr. The determine gave the impression to be in decline even earlier than the information that nation’s refineries would not settle for the ships.

“We anticipate and welcome that world oil consumers can be a lot much less prepared to cope with Sovcomflot than up to now,” a US Treasury spokesperson stated, including that the measures should not have any oil market impression as a result of Russia will preserve an incentive to promote oil.”

Now that fleet might want to discover work elsewhere — and there are indicators it’s struggling. A minimum of seven of the vessels have come to a halt within the Black Sea and disappeared from digital monitoring programs, tanker monitoring by Bloomberg reveals. Sovcomflot admitted this week that sanctions had harm its operations.

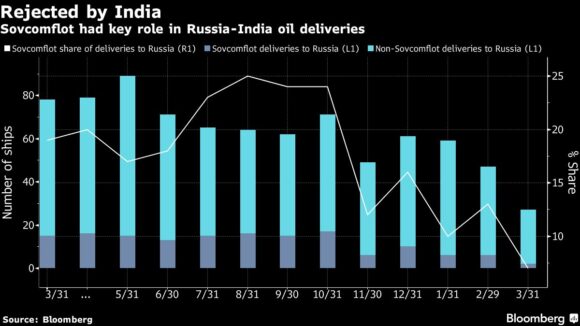

“The concentrating on of Sovcomflot represents a big tightening of US sanctions in opposition to Russia,” stated Janis Kluge, senior affiliate for Japanese Europe and Eurasia on the German Institute for Worldwide and Safety Affairs in Berlin. “It is not going to clear up the issue of circumvention, however it’s going to drive up transport prices and worth reductions for Russian oil.”

Even so, Russia can nonetheless draw on a so-called “shadow fleet” of vessels amassed shortly after the 2022 invasion — typically older ships with out correct insurance coverage and with unclear possession — to make its deliveries. By some estimates, there are as many as 600 such carriers in operation, alongside Greek tankers that proceed to serve the commerce below the G-7 worth cap.

Supply prices for Russian oil are enormous. It prices about $14.50 a barrel to ship a Baltic Sea cargo to China, in accordance with knowledge from Argus Media. Nicely over half that sum is attributable to sanctions, it estimates.

“Whether or not this turns into precise provide losses will depend upon how shortly workarounds are discovered for freight points and whether or not Russian sellers are prepared to deepen reductions,” stated Bronze at Vitality Elements.

An additional setback for Moscow has emerged in its sale of refined fuels. A mean of 6.2 million barrels of Russian diesel was floating within the 10 days to March 17, in accordance with knowledge from Kpler That’s the best the measure’s been since at the least 2017.

Whereas it’s not clear that sanctions have induced the buildup, it’s hanging that a lot product is accumulating at a time when drone strikes should have curbed provides.

“Washington nonetheless has highly effective instruments to harm Russian oil exports, however has used them cautiously, fearing a spike in gasoline costs in an election yr,” stated Kluge.

Copyright 2024 Bloomberg.

Subjects

Vitality

Oil Fuel

Washington

Russia

Desirous about Vitality?

Get automated alerts for this matter.

[ad_2]

Supply hyperlink